History of Coal

During the 1980s, global diversified mining companies, domestic steel companies, electric utilities, and integrated oil companies controlled coal mining assets. Corporate strategies were around maximizing volumes, and gaining market share. Electric utilities, the primary customers, had considerable pricing power over the coal producers. Many competitors exited the industry through consolidation or bankruptcy.

In 2000, a 20 year long bear market for coal found a bottom when increased electricity demand and a sharp climb in oil and natural gas prices forced utilities to look to coal producers to restock inventories and meet generation requirements. Contractual commitments at lower prices prohibited many coal producers from timely meeting those needs and thus prices began a long uptrend. Today, management teams have become more disciplined about capital investment and returns and have also moved to a market driven strategy as opposed to a production driven one.

Supply

Surface mining methods are generally used to extract coal west of the Mississippi. Large underground mines can be found in Pennslyvania and West Virgina. Eastern US coal is in tight supply due to periodic mine closures.

Demand

Coal’s total electricity generation has ranged from between 41% and 51% of the total during the past 20 years. Natural gas is becoming a substitute due to low prices. Nuclear power is losing share post the Japan earthquake.

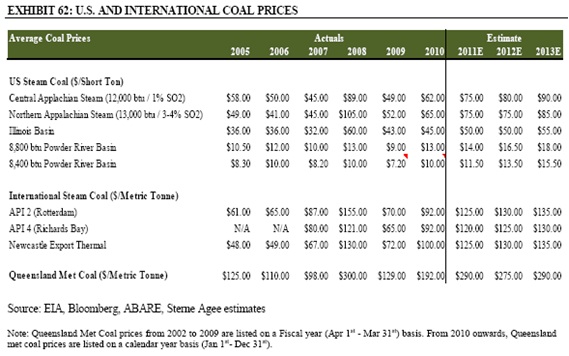

Pricing

Pricing for Central and Northern Appalachian thermal coal is higher due to its proximity to the East Coast power plants and the supply constraints as mines close down. Powder River Basin rices are very low because most mines are surface mines that are low cost to extract. Met Coal that is used for steel making is much higher priced due to strong demand (China) and weak supply (Australian floods).

Transportation

About 58% of mined coal output is shipped by rail, 22% by inland waterway, 11% by trucks, and 8% by conveyor belts directly to power plants.

Metallurgical Coal

Metallurgical coal (also known as coking coal) is used in the production of steel. Met coal is a low-ash, low –sulfur bituminous coal with a heating value between 12,000 and 14,000 Btu per pound, which differentiates it from thermal coal that have lower heating values. Australian producers and Japanese buyers annually negotiate the benchmark met coal price for the April-March fiscal year. In 2008 and 2011, severe flooding impacted export volumes from Australia, which helped met coal prices rise from $100 in 2007 to $305 in 2008. Prices rose from $225 in 1Q11 to $330 in 2Q11. Since 2010, the met coal industry moved from annual fixed priced contracts to quarterly contracts. The move to shorter contracts opened the door for US exporters to increase volumes.