Bernstein note 10-12

The mechanics of onshore production are fundamentally different from offshore production. The largest 25 fields off Norway today were developed with 110 total wells per field on average; the largest 25 fields in the Gulf of Mexico were developed with 30 wells on average; while typical Russian fields of the same size (in kbpd) required 1,080 wells to develop: an order of magnitude higher, reflecting lower well production rates of 400-600bpd (versus 2.4kbpd in Norway and 9kbpd in the GoM deepwater).

Russian onshore fields have a “sluggish” production profile, typically taking a decade to ramp up to peak. It takes 6-7 years to recover half of the oil from the average Norwegian / UK field. A “peaky” GoM field can recover half of its oil after 2-3 years. But in Russia, it takes as long as 20-years to recover

half of the oil at a typical field, based on the production profiles. Because of the time value of money, these “sluggish” production profiles yield 40% lower NPVs per barrel than offshore production profiles. We estimate undeveloped Russian oil resources are worth $0.7/bbl when fiscal terms are considered.

Forward-looking Russian decline rates are likely to be higher than the past, at -3.5% on average. Russian fields’ decline rates accelerate as the fields mature. Today the weighted-average barrel in Russia is produced from a field that has been in production for 30-years. Only 12% of production is from fields in their first decade of production (when production typically ramps up) vs 30% two decades ago. Incorporating this higher decline rate from very mature fields in our oil market models would subtract 0.5Mbpd of supply by 2015 & 0.7Mbpd by 2017 and increase oil price forecasts by 5%. Our 2017 Russian forecast, at 9.7Mbpd would be 0.85Mbpd below the IEA’s recently updated estimate, using this decline rate assumption.

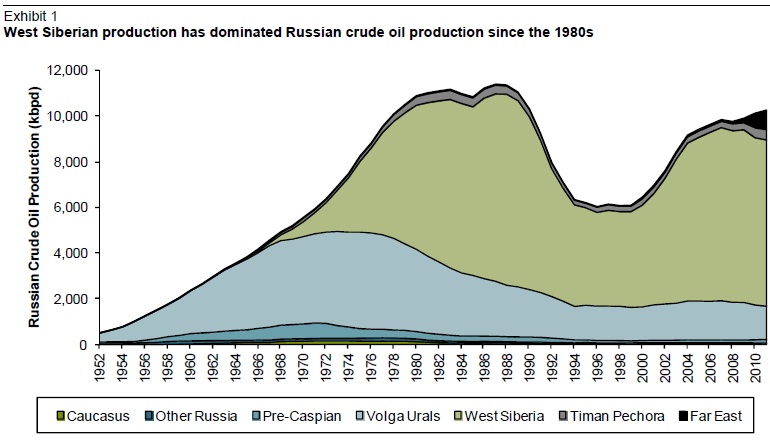

The History and Maturity of Russian Onshore Production

Russian oil production ramped up to 11.4Mbpd at peak in 1987-8 according to the BP Statistical review, and fell precipitously after the collapse of the Soviet Union, before a reorganization of the upstream industry in the late 90’s and early 2000’s recently restored output to a new high: 10.4Mbpd this year on average (Exhibit 1). Although Western Siberia is the largest component of Russian output today, at c70% of the total country’s production, its ramp-up took-place mostly in the 1970s as Pre-Caspian and Volga- Urals production matured and declined. Today, West Siberia is in decline, while recent growth has been driven by greenfields and increased production in East Siberia, Timan-Pechora and the Far East.